Data driven objectivity. Proprietary research. Outside the box thinking.

Our Investment Strategies are built on decades of research and experience. Lyons Investment Management and predecessor companies have performed hundreds of intensive research studies on corporate practices and investor behavior. These, used in conjunction with our proprietary computer-based statistical models, allow us what we believe is an unique insight into the companies that we select for our various strategies. By applying this insight we strive to deliver superior returns for our clients in line with their investing goals.

Our strategies can be divided into those that use Fundamental analysis, a method of measuring a security’s intrinsic value by examining related economic and financial factors, and those using Quantitative analysis, a technique that seeks to understand behavior by using mathematical and statistical modeling, measurement and research.1

Our strategies generally focus on smaller companies (small cap stocks) because we believe that these methods of analysis are more likely to be effective with companies which are less widely owned and researched.

Explore our strategies and the investment processes we use for them below.

Fundamental Strategies

US Small Cap Value Strategy

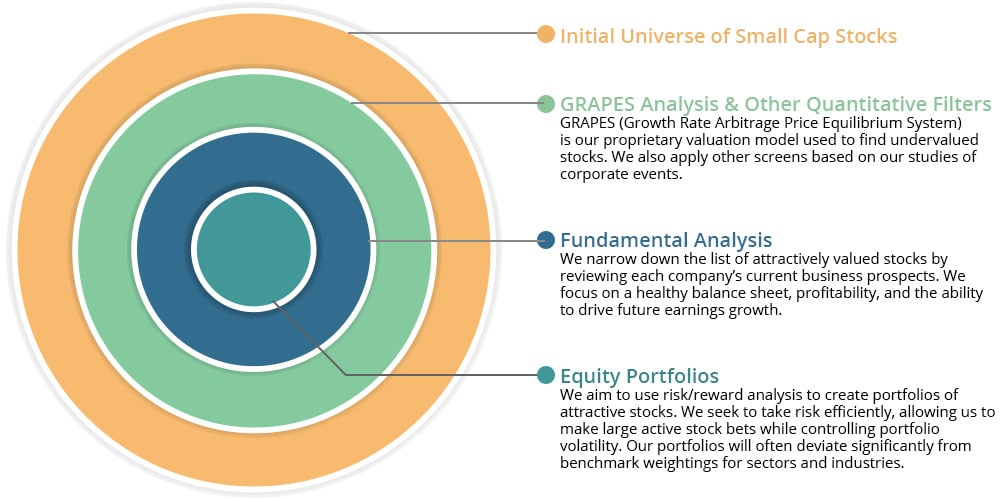

Our original strategy with a track record approaching 20 years, the US Small Cap Value strategy consists of 30-50 small cap value stocks traded on US stock exchanges. We utilize our Fundamental Process, including our proprietary GRAPES valuation model, to screen the universe of mid, small and microcap companies in order to find attractive candidates. We’re typically looking for companies with strong current operating results and conservative balance sheets which are trading at discounted prices.

Global Equity Strategy

The Global Equity Strategy consists of both U.S. and International small cap value stocks. For international stocks, we apply the same Fundamental Process we use in managing our US Small Cap Value strategy in select foreign markets. The weighting between countries reflects our long term thinking regarding the attractiveness of different markets and is often substantially different than index weightings. Currently, the majority of stocks in the Global Equity Strategy are also stocks contained in either our US Small Cap Value or our All Asian strategy.

All Asian Equity Strategy

The All Asian Equity strategy applies our Fundamental Process to find undervalued stocks in select Asian markets, both developed and emerging. The weighting between different Asian countries reflects our long term thinking regarding the attractiveness of different markets and is often substantially different than index weightings.

Our Fundamental Process

Quantitative Strategies

Volume Winners Strategy

The Volume Winners Strategy is one of three quantitative strategies which utilizes our research into lower volume stocks, specifically in the microcap universe. In this version we combine low volume with price momentum and low short interest. We further weed out volatile and overvalued stocks. The concept is neglected stocks which are doing well but have still not attracted market attention. Our goal for this strategy is lower sensitivity to major market indices while still preserving equity-like returns.

Volume Value Strategy

The Volume Value strategy also invests in microcap stocks and uses quantitative criteria. This model has two components: low volume and cheap earnings-based valuation. We also weed out highly volatile stocks. The concept is classic neglect – companies that the market is uninterested in and are priced inexpensively as a result. Our goal for this strategy is to produce higher returns.

Volume Momentum Strategy

The Volume Momentum Strategy is a combination strategy. It combines the Volume Winners Strategy with a momentum strategy called SuperMo. We believe these strategies are a natural combination since the two stock selection methods are relatively less correlated with each other. SuperMo is naturally a more volatile strategy while Volume Winners targets a lower volatility. Neither strategy has a value bias, which is different from most of our other strategies. The goal of the combined strategy is to produce higher returns.

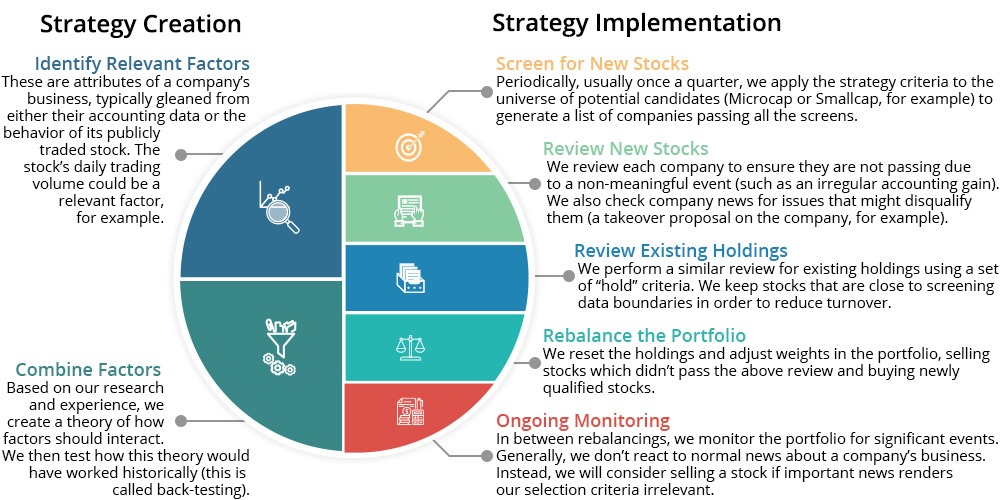

Quantitative Investment Process

Please note that investment objectives may not be achieved and are not a guarantee of future results. Investing involves risk, including possible loss of principal.

1Definition of Fundamental and Quantitative Analysis taken from https://www.investopedia.com/terms/f/fundamentalanalysis.asp and https://www.investopedia.com/terms/q/quantitativeanalysis.asp